Here’s how you can show retained earnings have changed from the beginning until the end of a certain financial time. In the course of the accounting processes of your business you might need to create a Retained Earning Statement. This will help people know the actions a company has taken in terms of its profits. The majority of accounting software can assist you in creating an account of your retained earnings for your company.

Table of Contents

What is an accounting of the retained income?

The statement of retained earnings reveals the fluctuations in retained earnings over the course of one year. Retained earnings are not given to shareholders in the form of dividends. Rather they are the money that the company has kept. The retained earnings rise when profits rise while they decrease when profits decrease.

A Retained Earning Statement can be often referred to as a declaration of shareholders’ equity , or an owner’s equity statement.

Retained earnings aren’t equivalent to money. In order to monitor how much cash flows in your company and also to find out how it changed over time , refer at the cash flow statement. flows.

statement of the equation for retained earnings

The formula to make the report of earnings retained is

Ending retained earnings plus net income minus dividends = end retained earnings

How do you prepare a statement of retained earnings?

This article will show you how to create an accounting of your retained profits for your company.

First Step

Decide on the financial period during which you will determine the amount of change

The majority of companies calculate the change of retained profits over the course of a year, however you can make an account on retained profits for the month or quarter if you prefer.

Second Step: Determine the beginning retained earnings

The retained earnings you earn at the beginning are merely the previous period’s end-of-year retained earnings. These earnings are reported in the equity section on the statement of balance (Assets = Equity + Liabilities).

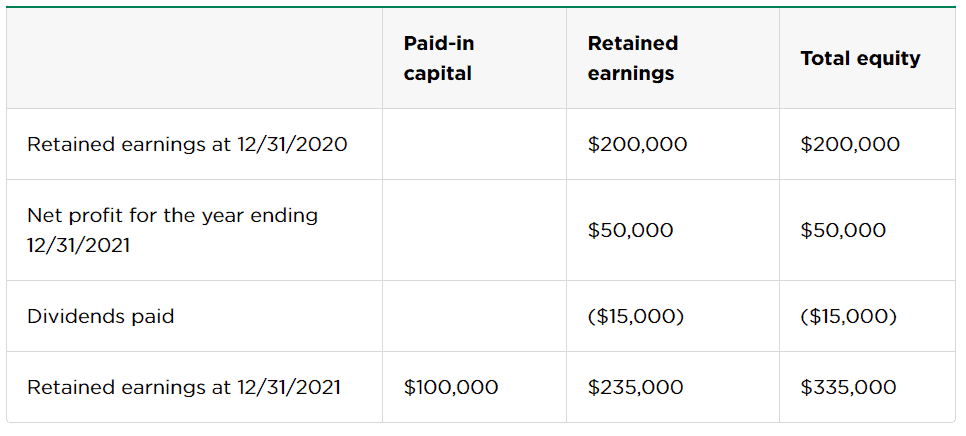

Let’s suppose you’re making the statement of your retained earnings in 2021. Your initial retained earnings are the retained earnings that are on the statement of balance at close of 2020 ($200,000 as an example).

Step 3: Add net income

If your company made net profits of, say, $50,000 , for 2021, you can add that to your retained earnings at the beginning.

Beginning retained earnings of $200,000 in 2020, plus $50 net income for 2021 equals $250,000.

Step 4: Subtract dividends

Then subtract the dividends you’ll need to pay your shareholders or owners for 2021. Let’s assume that’s $15,000.

Beginning retained earnings of $200,000 in 2020, plus $50,000 net income in 2021 $15,000 dividends in 2021 = $235,000 at the end of retained earnings.

Summary of earnings retained sample

Retained earnings statements is a simple statement or extremely thorough. Here are a few examples.

Example

If you deposit capital into your company and do not take it out in the future, it could alter the equity of the business, which may affect your retained earnings. For instance, if you make a $100,000 investment in your business in 2021, that is an investment not a loan that you plan to repay to yourself which is why it’s added to the equity of the company.

In this scenario it is recommended to extend the statement of retained earnings to reflect the extra capital that you have paid in. The updated account of the retained income may be like this