with the Nasdaq rising to new heights, and the tech sector always getting the highest marks as the most profitable sector in the market , it’s no surprise that many investors are looking into Nasdaq-related technologies or exchange trading funds (ETFs). ETFs function like mutual funds in the sense that it’s an investment pool which includes a range of security. In contrast to mutual funds they can be purchased and sold throughout the day on stock exchanges as normal share. This permits investors as also traders to get exposure to indexes, like the one of the Nasdaq100 and the Nasdaq 100, or as part of a buy and hold strategy , or to trade on the market during the day. It’s Invesco QQQ is an exchange traded fund (ETF) that is broadly held and is based on its own Nasdaq-100 Index. Its primary focus is international as in addition to U.S. companies operating in the healthcare, technology industrial utility, consumer discretionary, the consumer staples industry and the telecommunications sector. The triple-Q was previously known as QQQQ.

ProShares TQQQ functions in the form of an ETF. However, it’s a leveraged investment which makes borrowing of derivatives and loans to boost the returns to investors. Particularly TQQQ is a product that seeks returns that are three times the QQQ return.

Table of Contents

TQQQ

In the world of leveraged ETFs the ProShares UltraProQQ (TQQQ) is one of the strongest having assets under the management of $18.56 billion as of June 2022. TQQQ is also among the most commonly traded leveraged ETFs in the U.S. with an average daily volume of $5.29 billion (compared QQQ’s $21 billion). TQQQ has the cost-to-cost ratio of 0.95%.8

A large part of this is due QQQ’s popularity, due to its popularity and leveraged ETFs, issuers were able to reach traders looking for new strategies to take part in the Nasdaq 100. This is the situation with the ProShares UltraProQQQ (TQQQ). The purpose of TQQQ is to give triple the monthly gain of the Nasdaq-100. Therefore, in the event that the index increases by 1 percent on a particular day, TQQQQ can be predicted to rise in the range of 3 percent.

TQQQ as is the case with any leveraged ETF, it is an investment tool that should only be used in the duration of an intraday period rather than as a purchase-and-hold decision. Investors and traders who do not view them being “active” as well as “risk-tolerant” should stay clear of ETFs that leverage.

Based on ProShares the biggest distributor of leveraged ETFs. Leveraged ETFs are a riskier investment with particularities not found in conventional ETFs. ProShares says: “Due to the compounding of daily returns, holding for more than a day may yield returns very different from those of the target yield and ProShares returns over the course of more than one day could differ in terms of size and in direction with respect to the target return at the same time. This can be more apparent in funds that have higher or inverse multipliers and when it comes to funds with benchmarks that fluctuate.

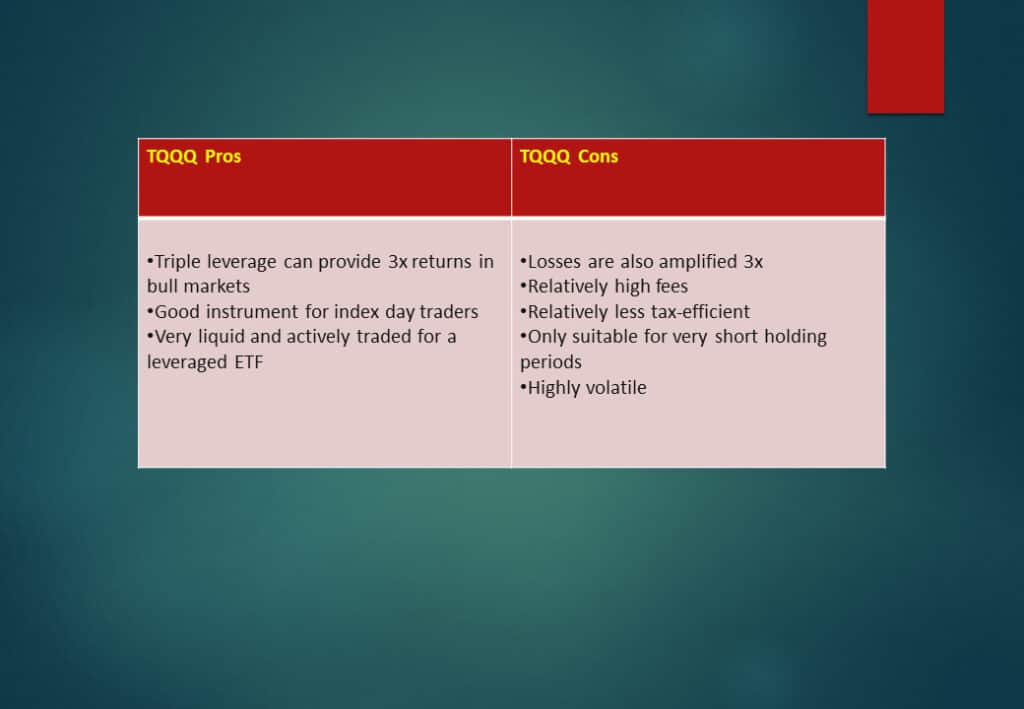

The TQQQ’s Pros and Cons

QQQ

There are a myriad of ETFs that offer an access point to Nasdaq indexes, the Invesco QQQ ( QQQ) is the most well-known of them all. With a value of $158.3 million in QQQ (as as on July 20 and 2022) is more than 20 years old, and is one of the largest ETFs that are plain vanilla that are available within the U.S. QQQ is component of the Nasdaq-100 Index, which is popularly followed and comprises the most well-known tech and internet stocks, which include Apple Inc. ( AAPL), Microsoft Corp. ( MSFT) and Google parent Alphabet Inc. ( GOOG) and numerous others.25

The highly-rated, large-cap fund was created in 1999. Its goal is to achieve results that are comparable with that of the Nasdaq-100 Index and has a gross expense ratio of 0.20 percent. QQQ pays quarterly dividends to investors who have average yield of less than 0.50%.5

QQQ focuses on a range of subjects that long-term investors look for in ETFs that offer large market coverage. The ETF offers a cost-effective, liquid exposure to a range of high-tech, large-cap, innovative companies without the need to burden investors with the process of picking stocks or the obligations associated with an specialized technology ETF.5

Tech stocks make up the bulk of QQQ’s worth along with the names of consumer discretionary and communication which comprise a large part of QQQ’s roster.5 While the Nasdaq-100 does have been known to be more volatile than the S&P500, QQQ can be traded over longer time periods, whereas its kin, TQQQ is definitely a one-time investment.

QQQ Pros & Cons

Pros

- Broad, low-cost, exposure to the Nasdaq-100

- Very actively-traded and liquid

- One of the oldest ETFs still in existence

Cons

- Constructed as a trust, may provide less efficiency compared to a true ETF

- Tech-heavy, can be more volatile than S&P 500 ETFs

the QQQ and the TQQQ: which one is more effective?

The advantages of these two ETFs is contingent upon the market outlook and the time-frame. If you are a long-term buy-and-hold investors The QQQ can be a good choice to get a broad exposure to the Nasdaq 100 Index. It can be combined with other ETFs which track indexes to build an investment portfolio that is well-diversified for investing over the long run.

If you think that the Nasdaq will rise within the next few months,, then the TQQQ might be the most suitable option since it can be leveraged. However, because of their structure, these leveraged ETFs are recommended to hold is from the time of creation to one or two days. Furthermore, should the index falls in any way it is possible that the TQQQ will likely lose 3 times more than QQQ. This means that TQQQ may be more suitable for traders who trade on day traders and also trading on swing traders.